1.Overview

The global economy has expanded more fast than the American economy over time. By nominal GDP, the United States has the largest economy in the world, and it has a significant impact on the international economy.

There have been ups and downs in America's steady and uneven drop in its share of the global GDP. Since peaking at 40% in 1960, the U.S. share of the world economy has been cut almost in half, despite a rising national GDP and being the birthplace of some of the biggest companies on the planet (The U.S Share of The Global Economy Over Time, 2021). Between 1965 and 1980,the country’s share fell by 13 percentage points, mainly due to stagflation of the 1970s(The U.S Share of The Global Economy Over Time, 2021). This decline was followed by Reaganomics and a period of strong recovery, which helped propel the U.S. share of the global economy back up to 34% by 1985 (The U.S Share of The Global Economy Over Time, 2021). Between 1985 and 1995, the U.S share fell by another 11 percentage points, only to bounce back to a local peak of 30% by the year 2000 (The U.S Share of The Global Economy Over Time, 2021)

The United States' percentage in the world economy has declined as a result of the tremendous expansion that many developing economies have seen since the turn of the twenty-first century. Until 2005, the U.S. still accounted for 28% of global GDP, but the Global Financial Crisis left a big dent, and its share fell to 23% by 2010; it has since remained relatively stable at 24% (The U.S Share of The Global Economy Over Time, 2021). It's critical to consider the bigger picture of this deterioration. For instance, China’s share of the global economy grew from 4% in 1960 to 16.3% in 2019 (The U.S Share of The Global Economy Over Time, 2021). Other nations including South Korea, Brazil, Mexico, Indonesia, and India all experienced their rise to prominence on the global economic scene during the same time frame.

2.Recent Global Influence

Three major areas of the U.S. economy exceeded projections in 2023: rising economic production, robust labor market, and declining inflation. The advancements the United States of America has accomplished in terms of inflation, labor markets, and growth are noteworthy worldwide and continue to be a major source of support for the world economy. The ability of the global economy to withstand hardship is a credit to the coordination of policies and international collaboration that has enabled The U.S. to continue its recovery from the epidemic.

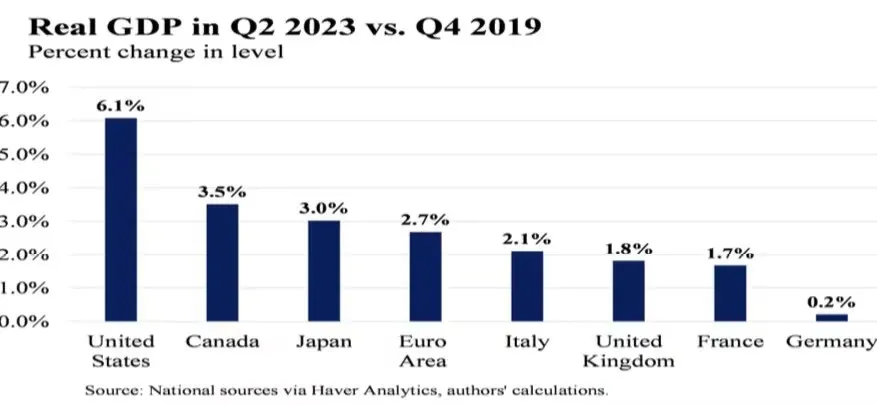

There has been significant variation in the pace and distribution of the global recovery across various nations. Even today, most advanced economies are below the trend growth path that they were on before the pandemic – except the United States, which is on track this year to return to reach the level that would have been predicted by the pre-pandemic trend (The U.S. Economy in Global Context, 2023). But given its quicker return to trend growth, the United States is the closest, real output is only 1.4% lower than if pre-pandemic trends persisted (The U.S. Economy in Global Context, 2023)

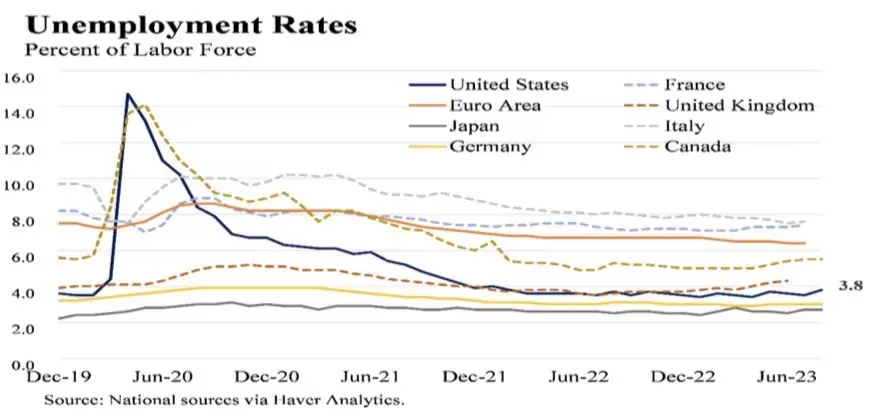

It can be particularly challenging to compare unemployment rates across economies due to variations in national labor laws. Nevertheless, the G7's unemployment figures during the COVID era differ significantly from one another. The United States and Canada experienced high spikes in their unemployment rates in April and May of 2020 and supported workers through supplemental unemployment insurance, while several European economies with workshare schemes saw declines in their unemployment rates (The U.S. Economy in Global Context, 2023). However, after the COVID shock the U.S. unemployment rate rapidly improved and has been consistently below 4 percent since January 2022 (The U.S. Economy in Global Context, 2023). Amid the most rapid monetary tightening cycle since the 1980s and an increasing labor force participation rate, the jobs market in the United States remains strong with a current unemployment rate of 3.8 percent (The U.S. Economy in Global Context, 2023)

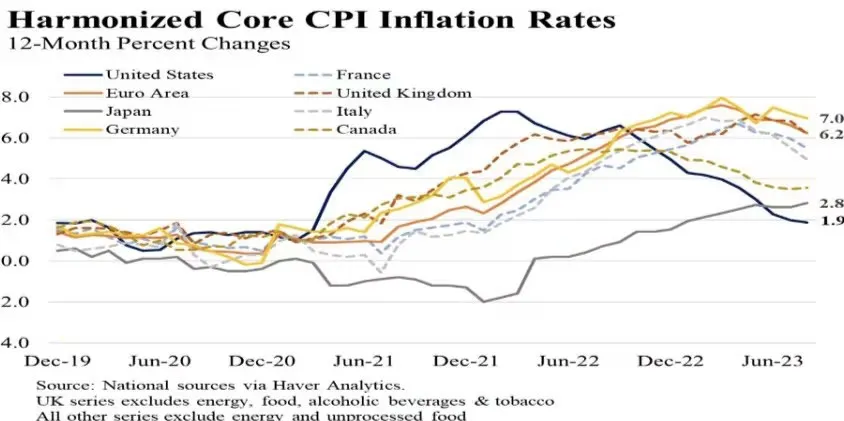

U.S. core CPI inflation (excluding food and energy) has declined significantly over the last 12 months (The U.S. Economy in Global Context, 2023). However, because various nations have varying rules for what goes into their inflation consumption baskets—most significantly, owners' equivalent rent—cross-country comparisons are rarely straightforward. High inflation has been a common occurrence in the majority of developed countries. Although inflation in the United States rose earlier than in other G7 economies—reflecting the brisk recovery from the pandemic—it also fell sooner and quicker (The U.S. Economy in Global Context, 2023). The Russian invasion of Ukraine caused significant increases in the price of food and energy, some of which trickled down to core inflation, accounting for a portion of the economic gap with respect to European economies. Despite this difficulty, these economies have recently displayed some encouraging tendencies for their short- and medium-term outlooks: hints of disinflation.

Stronger-than-expected U.S. growth continues to drive surprises to the upside in global growth in 2023, and the IMF notes that the likelihood of a hard landing has receded and the downside risks from last spring have moderated (The U.S. Economy in Global Context, 2023). The progression of the U.S. economy highlights the importance of a quick and growth-oriented policy response while making significant investments in the economy's long-run productive potential, even if there are still significant dangers to the U.S. economy.

3.Forecast for 2024

Anticipations point to a dull start to 2024. Although there is now more hope for a soft landing, there is still a perception that volatility will befall the US economy this year. It is anticipated that Q2 and Q3 2024 would see somewhat negative GDP growth, which might have a widespread impact on the economy. But late 2024 and early 2025 should bring in a more predictable and less volatile phase. Interest rates and inflation should return to normal, and GDP growth should approach its potential at somewhat less than 2 percent.

US consumer spending held up remarkably well in 2023 despite elevated inflation and higher interest rates (The Conference Board, 2024). But this pattern is not expected to continue. Real disposable personal income growth struggled to outpace real consumer spending for much of H2 2023, pandemic savings are dwindling, and household debt is rising (along with delinquencies) (The Conference Board, 2024). Additionally, the growth in ‘buy now, pay later’ plans may also weigh on future spending as bills come due (The Conference Board, 2024). It follows that the increase of consumer expenditure overall is expected to decelerate in Q1 2024 and subsequently decline in Q2 and Q3 of that same year. It is not anticipated, nevertheless, that the state of the labor market will significantly worsen. By the end of 2024, consumption should start to rise again as interest rates and inflation decline.

Following a pop in Q2 2023, business investment growth slowed materially in Q3 2023 as interest rate increases made financing activities more expensive (The Conference Board, 2024). [For] 2024 this trend should intensify as the Fed resists calls to cut rates until mid-year (The Conference Board, 2024). Residential investment, which had been contracting since 2021, began to grow again in Q3 2023 (The Conference Board, 2024). The cause was the ongoing need for housing and the scarcity of available inventory. Looking ahead, nevertheless, it is not anticipated that residential investment growth would significantly increase until interest rates start to decline.

Government spending was a positive contributor to growth in 2023 due to federal non-defense spending associated with infrastructure investment legislation passed in 2021 and 2022 (The Conference Board, 2024). However, growth is likely to slow in 2024 and 2025 as infrastructure spend out stabilizes (The Conference Board, 2024). In addition, during the coming years, political unpredictability over debt, expenditures, and fiscal policy may have an effect on government spending.

Labor market tightness has been remarkably persistent in 2023, but recent data show some moderation (The Conference Board, 2024). There are no major indicators showing that labor markets would collapse, even though this should persist throughout the upcoming quarters (as was the case in prior recessions). The tightness is mostly due to the Baby Boomer generation's retirement and declining labor force. In fact, this tenacity ought to help a recovery the next year by keeping overall economic growth from falling too far into contractionary territory.

Inflation should see consistent progress over the following quarters. Oil, and consequently energy prices, are falling (The Conference Board, 2024). Meanwhile, price pressures emanating from dwellings and services continue to moderate (The Conference Board, 2024). Notably, services demand should cool as consumer spending wanes. Expectations of year-over-year inflation readings may hit the Fed’s 2 percent target in Q3 2024. This expectation will trigger rate cuts starting in Q2 2024. Readings of 25 basis point cuts at every meeting are expected until rates fall below 3 percent in Q3 2025.

4.Conclusion

Every economy faces tailwinds and headwinds, but in the face of many strong headwinds, the U.S. economy has proven to be consistently resilient. The COVID-19 pandemic has changed the course of the global economy, with most countries experiencing a recession in 2020. America’s economic position will depend on how quickly it can recover compared to the rest of the world. The American consumer, backed by a persistently tight labor market and recently rising real wages, is one salient force behind this economic resilience.